The 9th Annual Real Estate Global Forum is the leading investor-centric event for LPs with allocations to Real Estate. This closed-door two-day forum will bring together US and international public and corporate pension plans, endowments, foundations, insurance portfolios, healthcare plans, investment consultants, family offices, HNW wealth managers, and private banks.

Advisory Board

Michael Dineen, CFA, Senior Investment Manager, IBM Retirement Fund

Margaret (Peggy) Flynn, CFA, Director of Pension Management, Consolidated Edison

Jessica Long, Senior Director, Head of Sustainability, Americas, Nuveen

Eric Newman, Treasury Manager & Trustee, City of Stamford

John Mannix, Chief Executive Officer, Baldwin Brothers

Biff Pusey, Co-Founder & Member, CrossGrain Family Investments

|

KEYNOTE SPEAKERS

|

Kirk Sims, Managing Director, Head of Emerging Manager Program, Teachers Retirement System of Texas Kirk Sims heads TRS’ Emerging Manager Program. Since being established in 2005, TRS has committed $3.7 billion to one of the largest programs of its kind. An additional $2 billion has been invested directly with EM Program graduates. Each graduate was selected as a result of consistent outperformance among a group of more than 160 EM managers. Recognizing the Program’s success, in early 2019, TRS rolled out a plan to invest another $3 billion over the next three to five years. Sims joined the

Teacher Retirement System of Texas on March 1, 2019. Before joining Texas

Teachers, he was a Senior Investment Officer for the Teachers’ Retirement

System of the State of Illinois. Sims had oversight and management

responsibility of TRS’s Emerging Manager Program, a $750 million evergreen pool

of capital designed to identify and invest in emerging investment managers

across all asset classes. Prior, Sims worked at Prudential Retirement where he was responsible for a manager of manager’s retirement platform as well as an open architecture investment platform. He also has a background in asset management and has held various positions with both large and small asset managers.

Sims is a CFA

charter holder and holds a Masters in Business Administration from the Columbia

University Graduate School of Business. He received a Bachelor of Business

Administration from Howard University in Washington, DC. |

|

Amanda Pullinger, Chief Executive Officer, 100 Women In Finance Ms. Pullinger is the Chief Executive Officer of 100 Women in Finance. She leads a staff

team and provides direction to 500 volunteer practitioners globally. The organization, which

is in 27 locations, is focused on empowering women in the finance industry and inspiring the

next generation of pre-career young women.

Ms. Pullinger is a former principal of Aquamarine Capital Management, where she was

responsible, over a period of seven years, for managing marketing, investor relations and

back office administration for two private investment funds.

Ms. Pullinger is Chair and Non Executive Director of the Board of FlyPlymouth, based in

Plymouth, UK. She also serves on the Boards of the HALO Trust (USA), the American

Friends of The National Portrait Gallery (London) Foundation and as a Director on the

Oxford University Alumni Board. She is President of the Brasenose Society, Vice Chair of

the Women’s Network Forum and an Advisory Board Member of the Harambe Entrepreneur

Alliance (Harambe).

Previously, she served as Chairman of the Board of The HALO Trust (www.halotrust.org)

and served on the Board of Langone NYU Cancer Institute. She was on the founding Board

of 100 Women in Finance, serving as its President for two years. She is a member of the

British Academy of Film and Television Arts (BAFTA) and a Fellow of the Royal Society of

Arts.

Ms. Pullinger graduated from Brasenose College, Oxford University in 1987 with an Honours

Degree in Modern History. She earned an MBA from La Salle University, Philadelphia, in

1998, and received the Academic Award for MBA student of the year as well as the Beta

Gamma Sigma designation. |

|

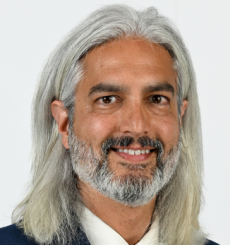

Craig Solomon, Chief Executive Officer, Square Mile Capital Mr. Solomon is responsible for managing all aspects of Square Mile’s business and investment activities and implementing Square Mile’s strategic objectives. Mr. Solomon is a principal partner in USAA Real Estate, a member of USAA Real Estate’s Board of Directors and Square Mile’s Board of Directors and a member of USAA Real Estate’s and Square Mile’s investment committees. Mr. Solomon served as Co-Managing Principal of Square Mile until June 2017. Prior to the formation of Square Mile’s first institutional fund, Mr. Solomon was the managing partner of Solomon and Weinberg LLP, a New York-based law firm specializing in all areas of commercial real estate and finance which Mr. Solomon cofounded in 1990, and a founding principal of SWH Realty Corp., a high yield real estate finance platform and Platinum Funding Corp., an asset based specialty finance firm. He has broad expertise in all facets of the real estate arena with particular expertise in fund formation, structured real estate finance/capital markets, joint ventures and partnerships, distressed transactions and remedies enforcement. Mr. Solomon is a 1979 graduate of Lehigh University and a 1982 graduate of the George Washington University School of Law, where he was a member of the Law Review. He began his career at Paul, Weiss, Rifkind, Wharton & Garrison. |

|

David Schwartz, Chief Executive Officer, Waterton Mr. Schwartz co-founded Waterton with Peter Vilim in 1995 and serves as CEO and chairman. Mr. Schwartz is responsible for strategic decisions and leadership of the firm’s business activities and operations, and participates on the Management and Investment Committees.

Prior to co-founding Waterton in 1995, Mr. Schwartz was a vice president of acquisitions for Equity Residential Properties Trust (EQR-NYSE) and, from 1985 through 1989, was with AMLI Realty Co.

Mr. Schwartz holds a bachelor’s degree in economics from the University of Illinois and an MBA from the University of Chicago Booth School of Business. He is a member of the executive committee, a senior officer and immediate past chair of the National Multi Housing Council (NMHC). He is a member of the Urban Land Institute (ULI) and is previous chair of the ULI Multifamily Blue Council and a member of the Pension Real Estate Association (PREA). Mr. Schwartz is a member of the Advisory Council for the Pritzker School of Medicine and the Department of Biological Sciences at the University of Chicago, and serves on the Strategic Advancement Committee for the U.S. Holocaust Museum and Memorial in Washington D.C. |

REQUEST AGENDA

Please note only corporate email addresses will be accepted.

Why do I need to enter my corporate email address?

By using your corporate email address, we can verify that you are a registered financial professional.

Key Discussion Topics

Investing in US Real

Estate

At first glance, the US Real

Estate investment outlook for the next 12 months seemed to be straightforward.

Growth was weak but steady until COVID-19 hit.

Outlook for Multifamily

Are residential real estate

investors more concerned about the effects of COVID-19, economic cycle, or the

residential supply/demand mismatch and why?

Opportunity Zones & the

Impact of Tax Reform on Real Estate Strategies

With the passage of tax reform

by Congress, many of the changes to the Internal Revenue Code that impact real

estate funds and their investors will now go into effect. How has the new tax

reform legislation affected strategies for both real estate fund managers and investors?

Allocating to Industrial Real

Estate

This panel examines how the

current changes in retail creating new opportunities for industrial real estate

including warehouse and distribution investments to facilitate the shift

to online purchases after COVID-19. Learn how industrial and logistics

investors are sourcing investments in geographies that have become bottlenecks

for global distribution and more.

Opportunities in Energy and

Infrastructure Investing

A high level overview on

the investment landscape in energy, what does it look like moving forward

and where is the smart money flowing? The nature of the energy sector is

facing accelerating rates of change. How do investors view the outlook for

investing in infrastructure moving forward?

Navigating Today’s Debt

Markets

Although bond markets have come

under stress in recent months with investors selling bonds to raise cash, the

Federal Reserve has issued programs to help. We will dive in to what

deals are or aren’t getting financed across property types and geographies

and analyzing how investors are exploring their options in terms of investing

alongside the Fed through new TALF funds.

Value-Added and Opportunistic

Investing in Today’s Market

Distressed real estate markets have investors eager for the

right time to take full advantage of this corona virus pandemic and buy at

record breaking lows. This panel examines the benefits and the drawbacks

of value-added and opportunistic investing in today's markets. With the effects

of COVID-19, deal volume is lower across all markets, when will we see the

shift?

Fundamental Factors in GP

Selection

Following the COVID-19 outbreak,

fundraising priorities have changed across the industry with LP's sitting

back for now with high levels of uncertainty. This panel will discuss

how investors are sourcing and screening managers for real estate

allocation during a global pandemic.

PRICING

| Early Bird I | 800.00 | 08/12/22 |

| Early Bird II | 1,100.00 | 09/05/22 |

| Pre-Event Registration I | 1,400.00 | 10/03/22 |

| Pre-Event Registration II | 1,700.00 | 11/07/22 |

| Event Registration | 2,000.00 | 12/06/22 |

VENUE

Harmonie Club

4 East 60th Street

New York, New York

United States 10022

CLICK TO VISIT VENUE WEBSITE