|

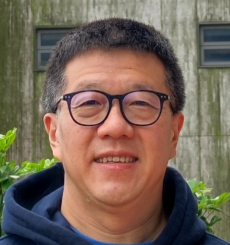

Poman Lo, Vice Chairman and Managing Director, Century City Holdings Limited and Regal Hotels International

Ms. Poman Lo is the Founder of the Institute of Sustainability and Technology, Founder & Managing Partner, AlphaTrio Capital, and also the Vice Chairman and Managing Director of Century City Holdings Limited and Regal Hotels International.

Poman serves as an Adjunct Professor teaching sustainable business management at The Hong Kong University of Science and Technology. She founded the non-profit Institute of Sustainability and Technology with a mission to nurture the next generation of ESG talent through executive education and advance the sustainability agenda through interdisciplinary research and community events.

Poman is the Founder and Managing Partner of AlphaTrio Capital, an Asia-focused sustainable technology fund that empowers innovative solutions for the world's most pressing environmental and social challenges. To promote decarbonization in business and consumer communities via a collaborative ecosystem, she launched MetaGreen, the world's first green metropolis in the metaverse.

To foster holistic well-being and positive values in children and youths, Poman established Bodhi Love Foundation to provide mindfulness-based training to educators and parents through its SEED (social emotional ethical development) program.

Poman is the only person in Hong Kong history to receive both the “Outstanding Young Person of the World Award” and the “Hong Kong Outstanding Students Award”. She is also the first and only female Asian recipient of the “Oslo Business for Peace Award” by the Business for Peace Foundation in Norway, selected by an independent committee of Nobel Prize Laureates in Peace and Economics.

|

Request Agenda

Request Agenda