The $44B Texas Municipal Retirement System (TMRS) has earmarked $15B in private market co-investments in the next five years, as it works toward building its portfolio around five megatrends.

The Austin-based pension fund will target a ticket size of $10M to $200M across co-underwrites, syndicated co-investments, secondaries, and growth capital investments, according to a news release.

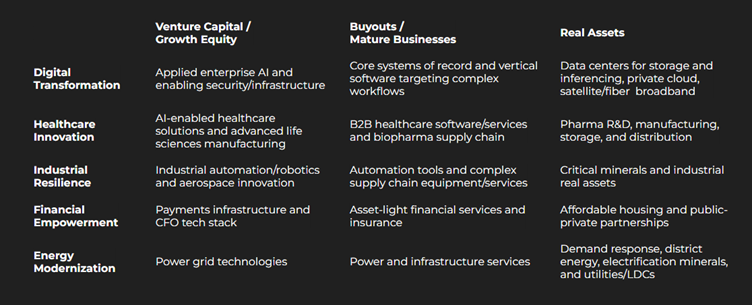

As a part of a thematic private investment program, the five global megatrends that will act as key investment themes for the fund are digital transformation, healthcare innovation, industrial resilience, energy modernization, and financial empowerment.

TMRS aims to invest around these themes through venture capital, buyouts, real assets, and structured equity or credit. For example, within digital transformation buyouts, the plan will target core systems of record and vertical software targeting complex workflows. In healthcare innovation real assets, the plan will focus on pharmaceutical research and development, manufacturing, storage, and distribution.

Further, within industrial resilience venture capital bucket, the plan will invest in Industrial automation/robotics and aerospace innovation. In financial empowerment real assets, the focus will be on affordable housing and public-private partnerships. Lastly within energy modernization venture capital, the investments will be in power grid technologies.

Source: TMRS’ news release

“As a small, thematically oriented team, we can identify transformative trends early, act with conviction, and compound expertise internally — positioning TMRS as a partner of choice for leading investors and companies while delivering lasting value to our beneficiaries,” said Yup Kim, the pension fund’s chief investment officer, in the release.

It also noted the investments will be duration and structure agnostic, with ability for long-term hold.

“We look to invest in companies leading or disrupting their respective industries,” said Amol Deshpande, TMRS’ managing director of private equity, in the news release. “The opportunity set of transformational businesses has never been greater. Our approach enables us to partner with these businesses across maturity stages and market cycles.”

Related stories:

TMRS prioritizing private markets co-investments

TMRS announces three senior staff hires