Editor’s Note: For the sake of allocators considering technology upgrades to their investment offices, we asked NYCBERS Sandy Rich and Antonio Rodriguez, as well and Ken Akoundi of Cordatius to write us their story on exactly what technologies they chose to improve and streamline their operations. What follows is in their own words.

By ANTONIO RODRIGUEZ, SANFORD RICH, and KEN AKOUNDI

“You never know what you can do until youtry,

and very few try unless they have to.”

—C.S. Lewis

Making the Case for an Upgrade

In witnessing the way digital transformation has affected our daily lives and how smartphones have changed our routines, we believed that technological advancements could have a similar effect on our investment office’s efficiency and productivity. We realized that setting an Investment strategy for a complex, $8 billion dollar combined defined benefit and defined contribution public pension system required more than a mix of different technologies. Therefore, we had to adopt digital transformation to remain competitive.

In order to tackle increasing allocation and governance challenges and stay up-to-date, the New York City Board of Education Retirement System (NYCBERS) decided to create its own investment office. This was a significant undertaking that involved forming a team, implementing best-practice processes, and choosing technologies to streamline operations and improve efficiency, all while seeking approval from the board and ensuring their expectations were met.

This is our story.

Pre 2019: Original State

NYCBERS is one of the five New York City pension plans with assets totaling around $250 billion. Representing approximately $8 billion of this total, NYCBERS provides significant benefits to the 55,000 current and retired non-pedagogic (teaching) -employees of the City of New York school system. The assets are managed as a single pool of capital and are held in seven distinct asset classes, including Public Equity, Public Fixed Income, Private Equity, Real Assets, Real Estate, Absolute Return, and Cash. NYCBERS isa manager of managers, with all assets managed externally.

The portfolio covers all combinations of depth and frequency of data, ranging from daily holding detail to quarterly fund returns. The Bureau of Asset Management (BAM) is responsible for overseeing the investment portfolio of the five pension systems, including NYCBERS. In this role, they provide investment advice, implement Board decisions, and report on investment performance. State Street serves as the custodian of the City of New York systems and provides monthly accounting valuations. NYCBERS’ Board participated in BAM-led monthly eight-hour Board meetings for the five plans. NYCBERS had no investment staff of its own and relied heavily on the Bureau of Asset Management (BAM) and its own consultants. Moreover, NYCBERS had no processes of its own and depended on its service providers, to perform asset allocation, select managers, manage portfolio risk, and generally monitor its portfolio.

2019-2020: Analysis, Design, and implementation

NYCBERS began its journey by adopting a clear vision statement to create Its first independent investment office, equipped with:

· Modern technologies and the operational models necessary to help make knowledge-based decisions

· A keen awareness of risk management as it relates to achieving financial targets and fulfilling fiduciary duties

· In cooperation with the New York City Office of the Actuary, incorporate asset liability and cash flow analysis into investment decision making

· The goal of integrating NYCBERS’s core values, all while maintaining a commitment to the efficiency of cost

Driving operating goals in designing this Investment Book of Record (IBOR) process included:

· Minimize the total number of technology components utilized in the investment office, while satisfying all the stated functional needs.

· Improve the quality of life of the investment officers.

· Improve the overall data quality and integrity, while simplifying its collection and normalization by establishing streamlined processes.

· Create a central analytics system with a single data warehouse servicing all asset classes

· Maximize self-reliance for overall manager selection and portfolio construction, especially for private assets.

· Improve the speed of delivery of information to the Board and its own staff

· Reduce/control costs

Three areas were determined as essential to the viability of the project. These included the selection and implementation of systems for:

· Quantitative portfolio management

· Document management

· Manager Selection digitization

After thorough dialogue and consideration of its unique structure, Cordatius and NYCBERS staff agreed on system architecture, compiled a list of desired functionalities, and identified a full inventory of necessary analytics. With this list in hand, we were able to select appropriate technologies for the project.

Our proposed architecture is specifically designed to facilitate investment portfolio decision-making by streamlining the collection of relevant information for each asset class. We also made sure that data flows needed for generating ABOR were maintained throughout the process. As a result, ABOR activities remain under the control of our custodian.

The process included RFP-based system searches that resulted in the selection of three cloud-based technologies:

· Caissa (acquired by Burgiss) for quantitative portfolio management

· Upmonth for document management

· DiligenceVault for manager selection digitization

The entire process spanned twenty months, resulting in the delivery of best-practice processes, three fully implemented technologies, efficient data collection and delivery, hiring initial staff, and training.

Today: Current state

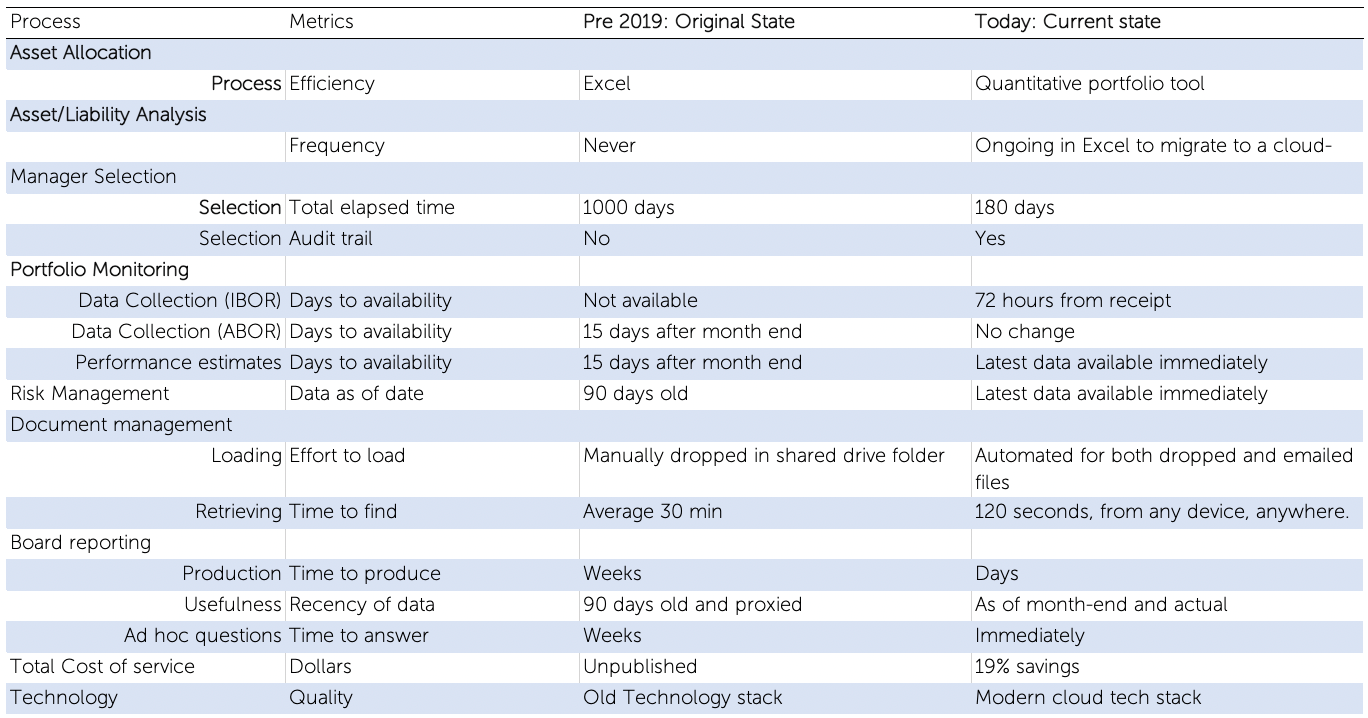

The project started in December 2018 and was fully completed in August 2020 (20 months). The selected technologies are fully implemented. As a result, the following tangible improvements have been observed:

The benefits across the projects affect every process, every function, and every individual. The benefits exceeded the initial expectation.

Lessons Learned

It would have been ideal if the process had gone smoothly, but unfortunately, we encountered mishaps, missed deadlines, and misadventures. However, we want to share what we learned from our experiences to assist you on your journey.

Have a plan: It may seem obvious, but it’s important to make a detailed plan before embarking on a project. Your plan should include specific goals, budget expectations, timeline, how the project will affect your team, and take into account the opinions and needs of stakeholders. Remember that your team will have to put in some work, so factor in labor responsibilities. By taking the time to think and plan thoroughly now, you’ll be better prepared and avoid surprises in the long run.

Start with an assessment: Undertaking a large project can be unpredictable, but having reference points or milestones is crucial for tracking progress. To properly assess your organization’s progress, it’s important to consider all aspects such as processes, staffing, governance structure, budgets, and financial position. Knowing your current position is essential for determining where you want to go.

It is about people first: Investment offices rely on both people and processes to create alpha. While technology can help improve the efficiency of these processes, it’s important not to forget about the people behind them. It’s crucial to consider their concerns, aspirations, and ideas.

Be honest about your staffing model and how it relates to your technology plan: When it comes to building out your investment office technology, it’s important to be honest about your staffing model. Your ability to hire will dictate your staffing model, which in turn will dictate your technology needs. Take the manager selection workflow as an example. If you can’t afford to hire highly trained staff by asset class, then opting for an all-in-one manager research system that allows you to program a stricter process may be more appropriate. Keep in mind that the competition for talent is fierce, so it’s important to be realistic about your hiring abilities in order to find the technology that best suits your needs.

Tie your technology to your Investment goals: When it comes to investment strategies, it’s important to remember that there are different technology solutions available for investment offices as well. The key is to make sure that the technology you choose is a good fit for your organization’s size, philosophy, and style. For instance, a small pension fund that only manages other managers will have different technology needs than an endowment that can invest directly in securities. It’s easy to think that more technology is always better, but that’s not necessarily the case. The key is to be honest about your organization’s needs and goals, and to choose technology accordingly.

Don’t do it alone: When it comes to turning your ideas into reality, there are often obstacles and challenges along the way. While you may be an expert on you organization and its goals, you and your team may not have the time or expertise to navigate every aspect of digital transformation. That’s where having a trusted advisor can make all the difference. Though working with an advisor may require an initial investment, it can ultimately save you time and resources by keeping your projects on track, streamlining processes, identifying potential issues, communicating with vendors, and keeping you informed of emerging trends and developments. With so much on your plate, every minute counts when it comes to managing day-to-day operations.

Don’t take on too much: It’s exciting to consider all the different technology solutions available for investment offices. However, it’s important not to take on too much at once in order to truly take advantage of the momentum. For example, finding the right solution for portfolio analytics may lead to the temptation to find solutions to everything else. But long-term success is not just about project management or initial implementation. The most important factor is adoption. Without adoption, all the upfront work is for naught. It’s crucial to give your team, leadership, and board time to learn, digest, and understand how to use the new technology before moving on to a new project. Don’t worry -getting it right and getting buy-in will generate enough goodwill to bide you time to pursue additional technology projects.

Believe in your beliefs: Our project is based on the belief that digital transformation has revolutionized and will continue to revolutionize investment decision making for asset owners. We believe that it’s important to hold onto this belief, as the end result of any project will ultimately improve the investment office, regardless of the direction it takes. Our inspiration came from observing how digital transformation impacted our daily lives. We were convinced that just as smartphones revolutionized our routines, these technological upgrades could enhance the effectiveness and output of our investment office. Our conviction was proven to be true.