The $4B Pennsylvania Municipal Retirement System (PMRS) is preparing to broaden its push into private markets, aiming to capture uncorrelated returns and strengthen portfolio resilience.

The pension fund has recently put out a formal call for managers in private credit and infrastructure — two areas seen as key to that effort.

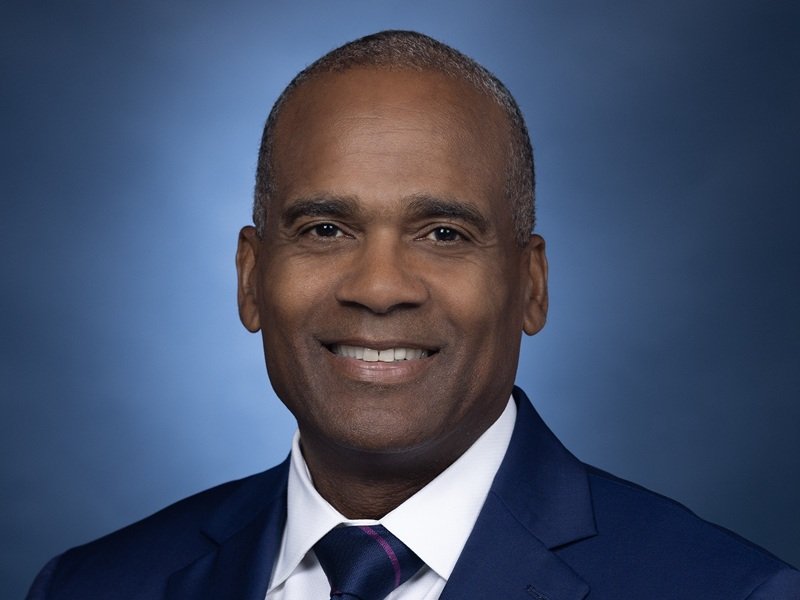

“Private credit and private infrastructure are two asset classes that have very low, even negative, correlation to traditional markets,” said Timothy Reese, the PMRS’ chief executive and investment officer, in an interview with Markets Group. “It’s a way we can strengthen the portfolio during inevitable periods of correlation. They can act as a governor, if you will.”

He pointed to the recent sell-off in “Magnificent Seven” stocks as a reminder of the need for vigilance. Recent market swings in the tech sector show how being over-concentrated in a few mega-cap stocks can put portfolios at risk.

To address this risk, the PMRS is turning to private markets, where it can diversify beyond the volatility of public tech stocks while capturing steady, uncorrelated returns. “Institutional investors must constantly seek new opportunities to diversify and enhance portfolios,” said Reese.

Having worked across the full spectrum of the investment world, he understands the weight of responsibility behind safeguarding the life savings of the pension fund’s beneficiaries. Reese acknowledged that the stakes are higher in his current roles: “With that [responsibility] comes an important truth: we don’t need to take outsized risks. The mandate is to preserve and steadily grow, not gamble.”

Shifting from growth to resilience

His current push into private markets is an extension of the framework Reese put in place when he joined the PMRS in 2021, which emphasized diversification and a focus on seeking assets that provide yield and stability while mitigating downside risk.

Back then, U.S. equities were buoyed by federal stimulus, but many, including Reese, saw signs that a correction could come swiftly. Before his arrival, the fund’s allocation mix carried a return-chasing tilt that Reese considered unsustainable — and unnecessary, given the system’s healthy funded status. “It wasn’t hard to say we could probably play this a little differently and at the same time lower some of our fees,” he recalled.

He consolidated the pension system’s equity allocations, merging separate large- and small-cap targets into a 32.5% domestic equity allocation and combining international and emerging markets into a single 17.5% non-U.S. equity bucket. Reese also replaced a broad real assets target with 10% in private real estate and 5% in agriculture (timberland). He also reshaped fixed income, shifting to a new 24% allocation to U.S. bonds and 5% to high yield.

As well, he reduced active management in equities while adding two active strategies to the fund’s largely passive fixed-income portfolio.

By the time markets inevitably corrected in 2022, the pension fund was well-positioned to recover from the fallout early into the following year. By June 30, 2023, the pension fund returned 8.4%, a marked increase from its -12.8% return in 2022. By Dec. 31, 2023, the net return had increased sharply again to 10.8%.

“What we witnessed in ’22 and ’23 was a stock-bond correlation that exposed fragilities in many institutional portfolios,” said Reese.

That year, PMRS further tweaked its allocation mix, committing up to $170M to an opportunistic credit fund, targeting a 5% allocation within fixed income. By December 2024, assets under management had risen 22%, which the fund attributed to Reese’s diversification and de-risking strategy.

“We lowered our beta and captured less of the downside during ’22, which allowed us to rebound in ’23 and ’24. Experience matters more than ever — if you’ve been through multiple cycles, you know how erratic markets can be. The key is to hold true to what’s in the best interest of plan members.”

Deepening private market reach

Similar to the framework implemented in 2021, Reese is seeking out core strategies where the fund can save on active management fees while tapping into difficult-to-reach markets that require managers with local expertise.

The credit strategy will see the PMRS deploy capital into select private debt assets that offer yield, downside protection, and fixed-income-like returns without locking up capital in ways that limit flexibility. The key lies in manager selection, he added.

“Everyone talks about underwriting risk. We spend real time evaluating whether a manager has demonstrated the ability to mitigate and manage risk over multiple cycles. When we find that discipline, we’re comfortable deploying capital.”

The PMRS’ infrastructure strategy will take both a global and domestic approach. In the U.S. market alone, opportunities abound, he said, noting ageing airports, bridges, and toll roads across the country require investment. He highlighted Pennsylvania’s PennDOT program, a public-private partnership infrastructure investment program, as a model for how infrastructure investments can deliver tangible benefits to both communities and pension fund members. Among the projects PennDOT has underway are six bridge replacements and compressed natural gas fueling stations.

Globally, emerging markets such as Asia and Africa represent the largest growth opportunity, said the CIO, noting Southeast Asia and India, in particular, are poised for massive infrastructure growth. As infrastructure projects in these regions often span 25 to 30 years, he noted they are a natural fit for a long-term institutional portfolio. As well, domestic consumption in Asia is driving development, he said, pointing out the way projects are funded in these regions differs from the U.S., where local municipalities often have less direct access to capital.

“Infrastructure is a durable theme. It provides stable, inflation-linked returns, and it aligns with the time horizon of our stakeholders.”

Some of the capital Reese said the PMRS is able to deploy to other areas stems from its paring back on real estate holdings. However, he noted private equity isn’t a big draw for the portfolio right now, given the current market environment. It also isn’t looking to chase returns or over-concentrate in fixed income, having already taken advantage of past opportunistic areas to build up a strong bond allocation. Instead, he said the priority is finding assets that maintain liquidity without sacrificing flexibility.

“That balance between yield, flexibility, and risk management is what guides our decisions.”

📌 Reserve your seat! PMRS’ CEO and CIO Timothy Reese will join Bryan Lewis, CIO at United States Steel Corp., in a fireside chat during Markets Group’s upcoming 11th Annual Pennsylvania Institutional Forum on Nov. 13, 2025.