A New Dawn in Real Estate: 2026 U.S. Commercial Real Estate Outlook

MetLife Investment Management

REAL ESTATE | December 2025

Key Questions and Preview Answers for 2026

1- If real estate prices troughed in 2024, why are investor allocations to real estate still shrinking?

Because of the magnitude of CRE underperformance since 2021.

2- What are the effects on real estate from K-shaped household income growth, and AI effects

on the labor market?

Risk for select office and retail segments, although office is still priced too low in select markets/

segments. A tailwind for select residential.

3- How long do multifamily margins compress in the Sun Belt?

We expect late 2027.

4- Is industrial still mispriced for growth or correctly priced for stability?

We have high-conviction views on infill vs regional warehouse pricing.

5- Are data centers in a bubble?

Maybe, but modern portfolio theory has something to say too.

Economic Outlook

Over the past year, high-income households have increasingly become the primary driver of

consumption growth. The top 10% of earners accounted for 50% of spending in 2Q25 (1),

which was the highest since data collection began in 1989. Meanwhile, real disposable income growth for the bottom ~80% slowed materially, as pandemic-era savings were exhausted and debt servicing costs increased,

particularly on revolving credit balances (2).

We expect this disparity in income growth to intensify in 2026, and this composition matters for

real estate.

In 2026, we expect leasing demand across most product types to be tied less to national aggregates

and more to where high-value employment and wage gains concentrate. That supports coastal

multifamily and select office submarkets, while tempering some Sun Belt locations.

At the same time, we believe an unrelated factor comes from an AI-linked labor adjustment.

AI adoption had a measurable impact on the labor market in 2025. Challenger, Gray & Christmas

reported nearly 50,000 job cuts attributed to AI, year to date; however, this figure is likely conservative,

as AI has also contributed to a decline in job openings. Estimates of total white-collar jobs eliminated

over the past 18 months range from 50,000 to 4,000,000, with only partial offsets from new roles in

the AI sector. We believe entry-level and administrative positions have been among the most affected,

but the net impact across the labor market remains uncertain. Over the next several years we expect

a reconcentration of office demand into markets with deep talent pools and industry clusters. Office

performance tied to generalized “return to office” narratives is likely to continue to be unreliable.

These labor market shifts and evolving demand patterns are reshaping the landscape for capital flows

and asset valuations. Against this backdrop, we examine how these forces are reflected in current

capital market conditions.

Capital Market Conditions

Private U.S. commercial real estate values bottomed in 4Q24 (NCREIF Property Index), with office the

last sector to trough in 2Q25. Transaction activity (CRE liquidity) improved throughout 2025 as bid-ask

spreads narrowed, although meaningful capital re-entry has not yet occurred. Allocation targets have

adjusted downward in many institutional portfolios, in some cases through formal revisions rather than

slower deployment.

This divergence between valuation stabilization and capital behavior is not unusual; however, the

drivers differ from those in the post-2008 cycle, when aggressive monetary easing, distressed pricing

and a slow but broad rebound in employment provided clarity to fundamentals across all property

types. Drawing on industry surveys, investor discussions, public pension disclosures and themes from

the Fall 2025 PREA conference, we see allocation targets trending lower. The primary driver: CRE

returns have lagged other major asset classes over the past three years. This has largely been due to

falling property prices, and investors are responding by recalibrating CRE allocation targets lower

rather than making new investments.

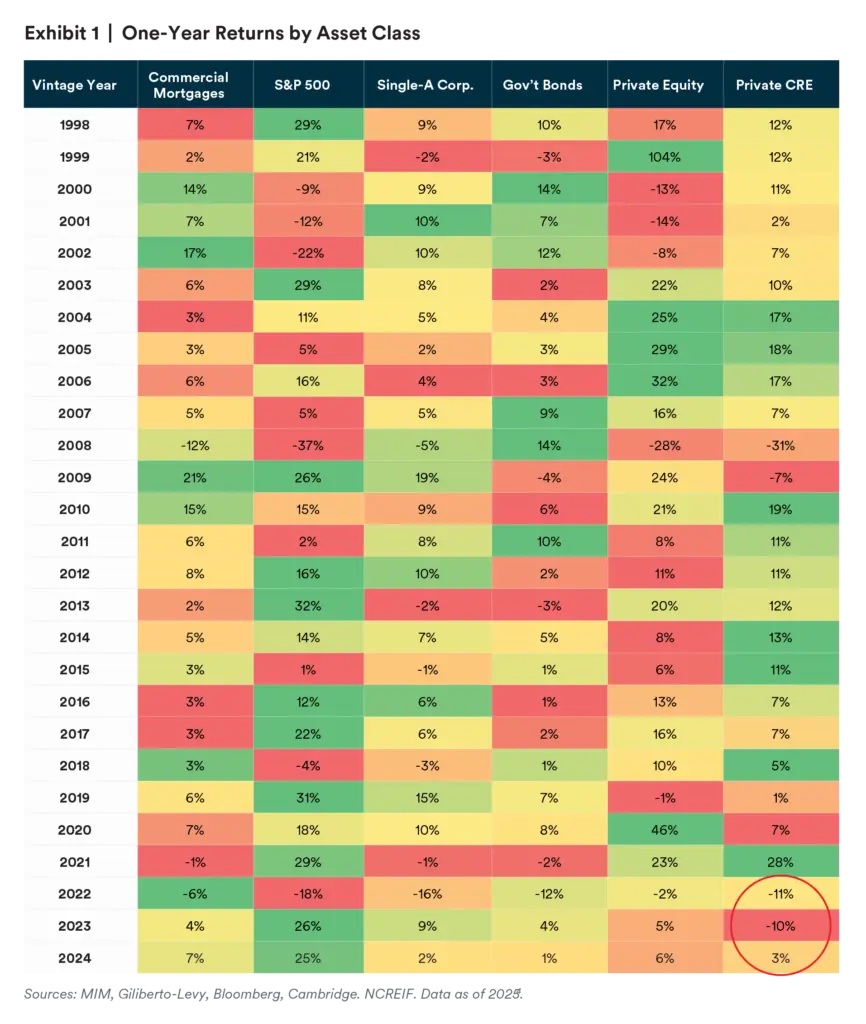

To show the magnitude of this underperformance, we compare the one-year performance across

major asset classes since 1998 (Exhibit 1). The table’s color coding considers the risk profile of different

investment sectors; for instance, government bonds returned 10% in 2011 and are coded as the best

sector with dark green, even though private CRE slightly outperformed on an absolute basis with an

11% return. Relative performance trends over the past four years have contributed to higher redemption

queues for open-end core real estate funds. Redemption queues began to rise in 2022, peaked at $41

billion in 1Q24 and have since fallen to just below $25 billion (3).

This persistent underperformance and shifting investor sentiment have direct implications for portfolio

strategy. With capital allocations in flux, it is critical to reassess sector positioning and identify where

fundamentals and pricing offer the most compelling risk-adjusted opportunities.

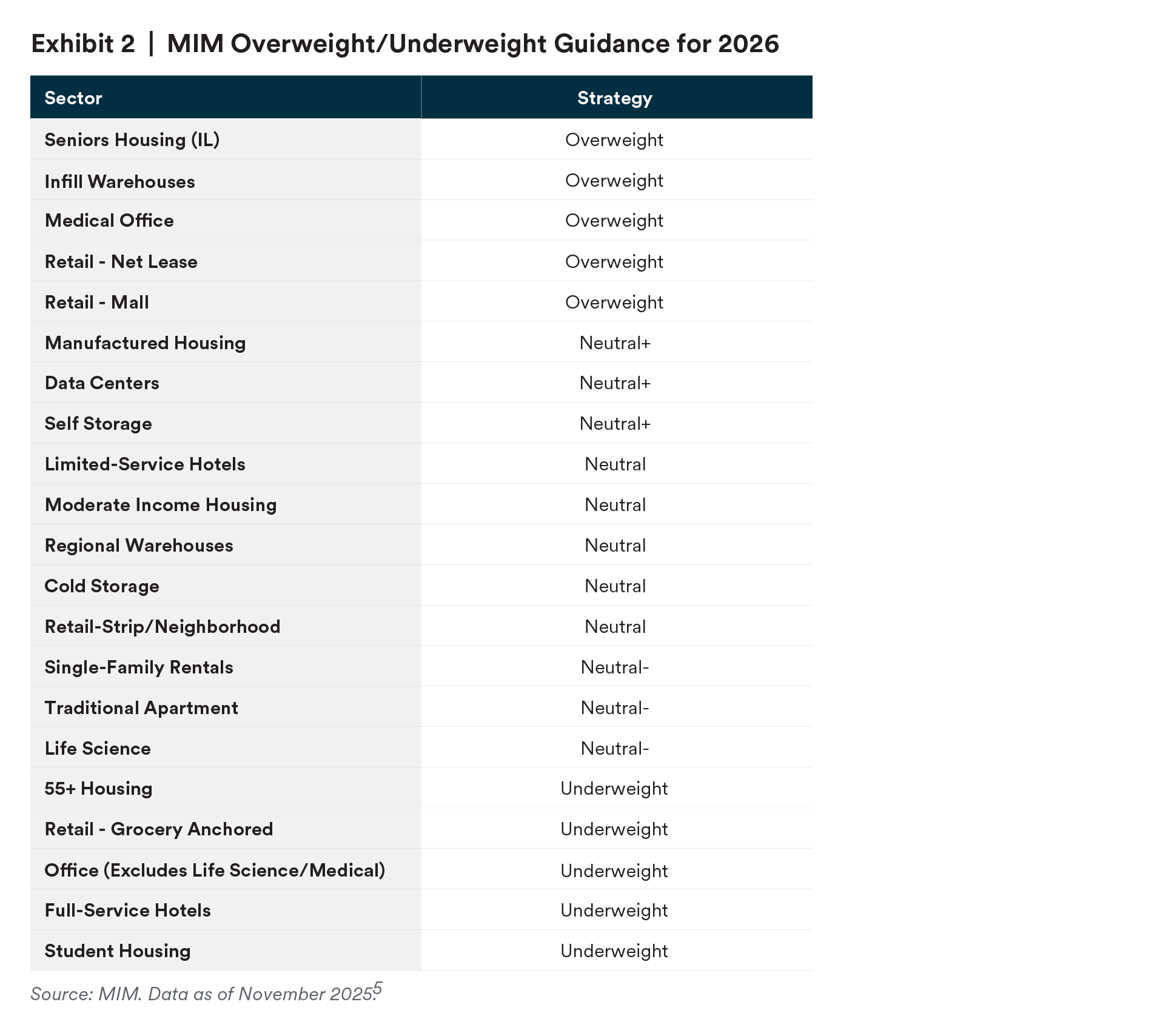

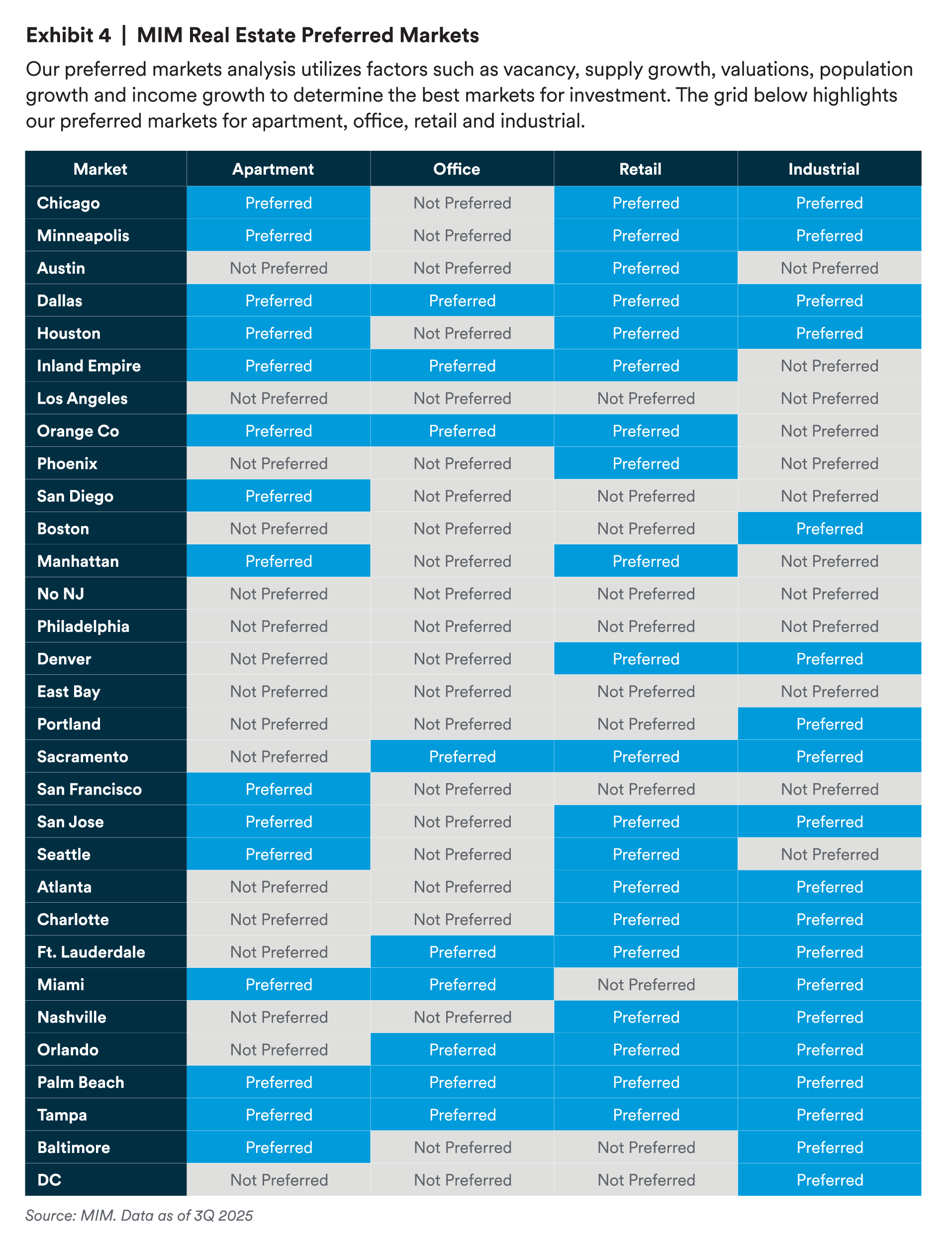

Strategy Guidance

Where are the opportunities and risks today? Here are the property types we expect to perform, best

to worst, in 2026, considering both spot market pricing and current fundamentals.

We update property type rankings monthly and assign ratings across 21 commercial real estate

sectors for portfolio managers and select public reports.

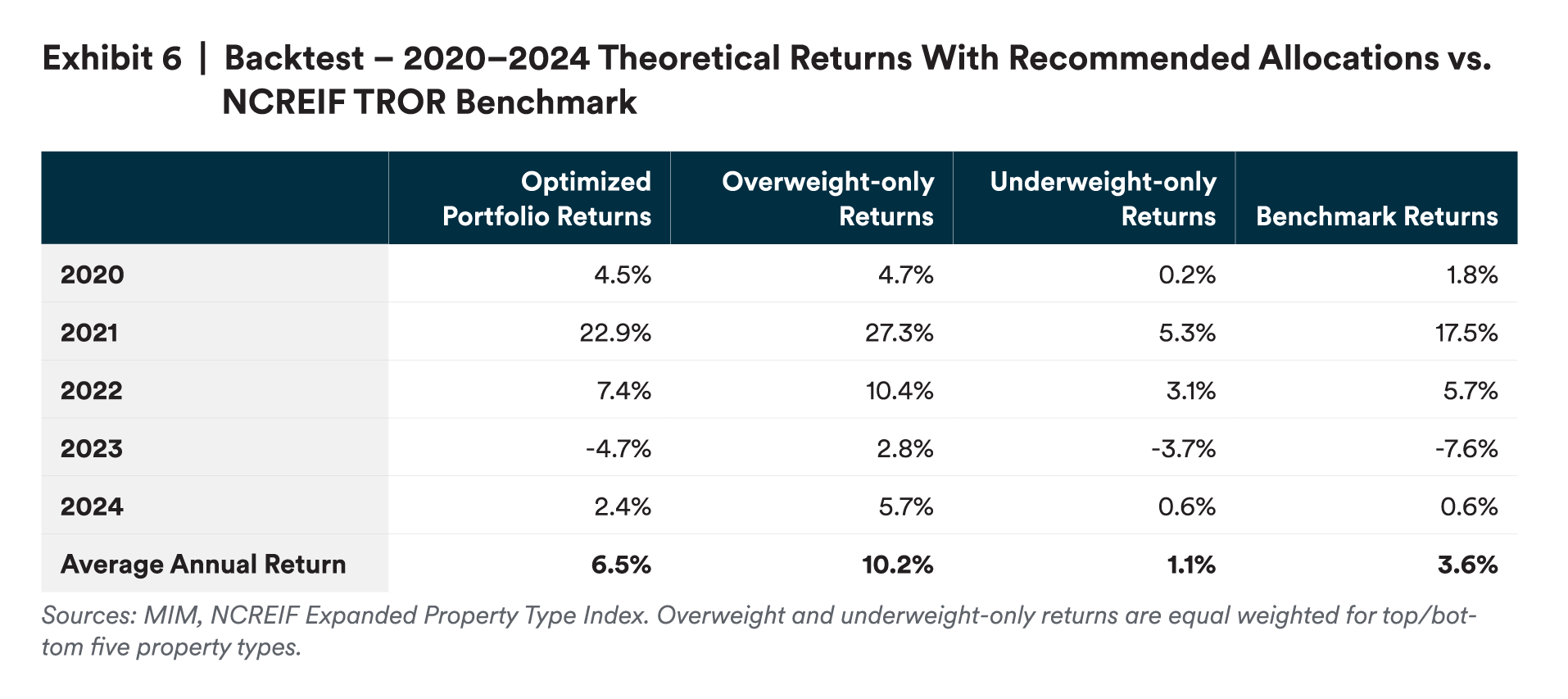

Each year, we also backtest the ratings. This year, we found:

- An unlevered portfolio modestly tilted toward overweight types, and away from underweight, would

have returned 6.5% from 2020 to 2024, while the NCREIF Property Index (NPI) benchmark was 3.6%. - Allocating only to overweight property types (equal weighted) would have resulted in an unlevered

annualized return of 10.2% versus the 3.6% benchmark. - Outperformance may be overstated, due to the assumption of immediate annual shifts, and

understated because the analysis uses unlevered returns. - Bear in mind that these returns are hypothetical and included for illustrative purposes only. They

are not actual returns and are not indicative of future results.

Backtesting isolates predictive signals. Our monthly regional survey and REIT options pricing have

proven most reliable, while demographic shifts and cap rates offer limited value. Within each sector,

we also believe there are important strategies to adopt or avoid. Leading into 2026, we have views

on markets and sub-strategies within the multifamily, industrial, office and retail segments. To

operationalize these sector views, we provide detailed guidance on the major property types.

Multifamily

We begin with multifamily, where supply-demand dynamics and market selection remain central

to performance. The multifamily sector has seen strong demand but continues to face elevated

supply, particularly in Sun Belt markets. We believe national apartment vacancy is at its peak and will

gradually lower throughout 2026, aided by a continuing slowdown in construction. Renter demand

will be supported by high homeownership costs.

High Conviction:

- Stabilized multifamily in supply-constrained markets such as Chicago, San Francisco, New

York, Palm Beach, Tampa, Seattle, Orange County and San Diego. There may be opportunities

to acquire Class A assets below replacement cost in markets where vacancy is tight. - Multifamily development in low-supply, high-barrier markets. Similarly, markets that are supply

constrained also present development opportunities.

Caution:

- Oversupplied multifamily markets such as Austin, Charlotte, Nashville, Denver, Phoenix and

Atlanta. Aggressive underwriting persists despite elevated vacancy rates and flat-to-negative net

effective rent growth. Federal immigration reform further impedes the recovery in fundamentals. - Value-add apartments. Deals are being priced with aggressive rent growth assumptions,

particularly in the Sun Belt. Investor competition for these assets is high.

Industrial

Industrial has been a top performing sector for the past decade, but now supply is outpacing demand.

Despite trade uncertainty, net absorption is expected to pick up in 2026 with vacancy peaking around

the middle of the year.

High Conviction:

- Industrial with medium WALT. Longer weighted-average lease term (WALT) is now favorable

given softened fundamentals and pricing. Acquire assets with below-market rents and mark to

market in years five to seven.

Caution:

- Industrial with lower WALT. Pricing is too aggressive on industrial properties with short-dated

WALTs. Vacancy is also rising in the industrial sector, particularly in the southern U.S.

Office

Signs of recovery have emerged in the office sector. The national average vacancy rate has fallen by

30 basis points (bps) since the start of the year, reaching 18.7% (6). In 3Q, net absorption (new leased

space minus space being given up) was the strongest in four years, reaching over 14 million square

feet (7). We expect to see continued improvement in the office sector over the next year, though B & C

office will lag higher-quality product. Investors prefer assets with longer WALTs, as in-place rents may

exceed market rents.

One of the most counterintuitive findings we’ve had in the last year is that properties with subleased

space have been outperforming assets with leased, but physically underutilized space. In MIM’s debt

and equity office portfolios, our worst investments have been in those with physically vacant space,

while those with subleased space have somewhat consistently surprised to the upside by converting

the subleases into long-term leases.

High Conviction:

- Higher-quality office assets. There are compelling yields for well-located, well-appointed assets,

especially in markets with strong talent clusters. - Repositioning existing office stock. In markets where prime office supply is low, there are

opportunities to upgrade A/A- stock into A+. - High conviction in preferred office markets based on pricing and fundamentals.

– Primary: Dallas, Orange County, Sacramento, Fort Lauderdale, Miami, Orlando, Palm Beach, Tampa.

– Secondary: Cincinnati, Louisville, Las Vegas, Providence, Norfolk.

Caution:

- Investors and investment managers materially underestimate the costs required to keep a building

current and leased. This trend predates the pandemic and has persisted for at least three decades. - Office to multifamily conversion. These are large deals, and assets are difficult to reposition.

Many transactions have aggressive underwriting assumptions.

Retail

The retail sector continues to see vacancies near historic lows, driven by a healthy consumer and a

dearth of new supply over the past decade.

High Conviction:

- Neighborhood centers and unanchored strip. Selectively acquire exceptional centers in high

demographic areas with lower CapEx drag. Accretive debt is available at acquisition.

Caution:

- Grocery-anchored retail. There is a significant premium for having a grocer in a retail center.

Grocery-anchored retail centers are exposed to anchor tenant risk, particularly due to Wal-Mart

expansion and rising e-grocery adoption.

Other Areas of Opportunity

Beyond the core property types, several other sectors present distinct opportunities and risks for 2026.

High Conviction:

- Defensive income. Medical office, net-lease retail, net-lease industrial and self-storage.

- Senior housing. Demographic trends are favorable for the sector, and there has been very little

new supply added in recent years. Asset pricing is favorable. - Data centers. Strong demand from AI-driven workloads, robust connectivity needs and projected

revenue growth of ~7% compound annual growth rate (CAGR) make this sector compelling. Strategic

markets like Dallas, Northern Virginia and Chicago also offer attractive pricing. While technological

obsolescence and a slowdown in AI funding are risks, these risks are largely idiosyncratic and

not strongly correlated with broader economic cycles. According to Modern Portfolio Theory,

assets with distinct risk drivers, such as data centers, provide diversification benefits within a

mixed real estate portfolio. This allocation can enhance risk-adjusted returns by reducing overall

portfolio volatility, even if individual sector risks remain. Additional considerations include potential

oversupply, regulatory hurdles and cost volatility from tariffs and urban site constraints.

Caution:

- Student housing. Demographic trends are not favorable for the sector as the population of

college-age students is declining. Construction pipelines are also concerning across many

college campuses. Although this may seem contradictory, we maintain a favorable view for

debt investment in student housing. For lending, our focus is on larger universities with strong

enrollment and high barriers to entry.

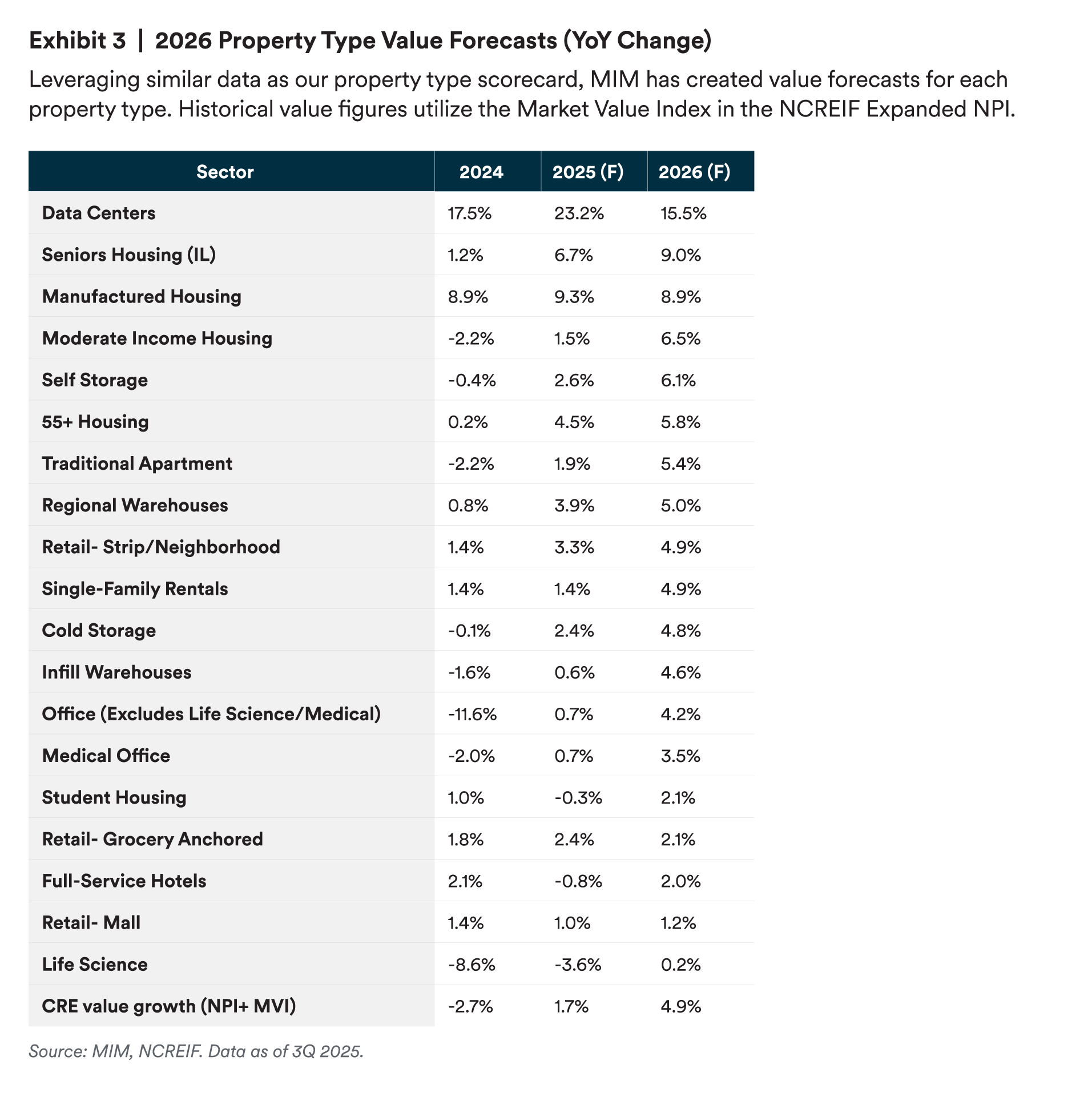

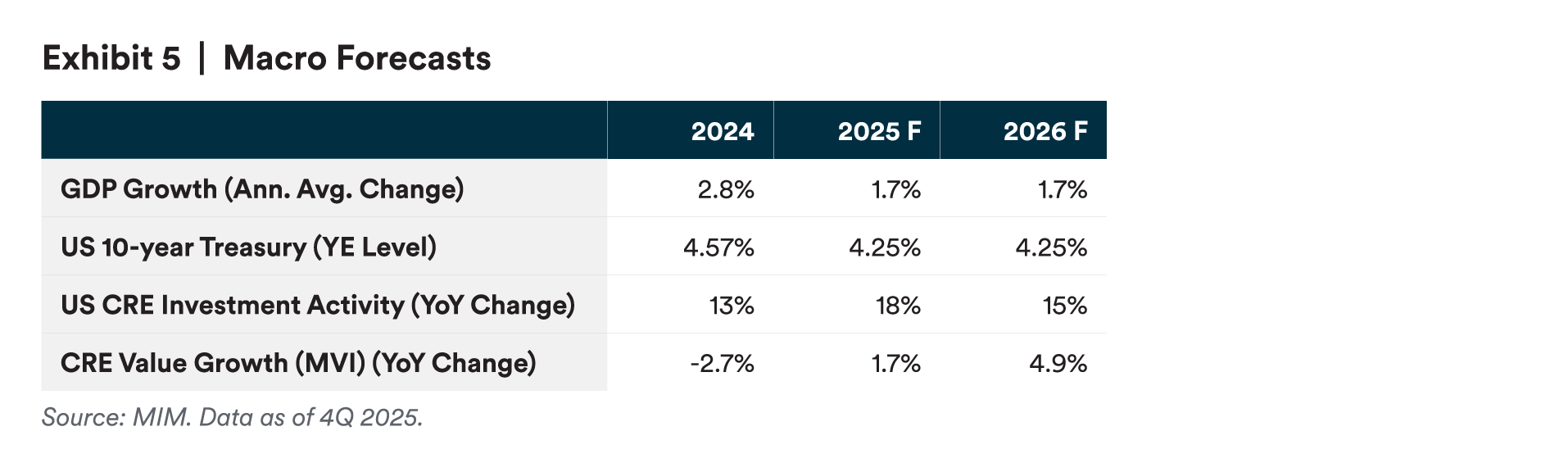

Appendix and Forecast Tables

With sector-level guidance established, the following appendix provides supporting forecasts and

quantitative detail for reference.

Authors

Appendix and Forecast Tables

1- Source: Marketplace. Nearly half of U.S. retail spending comes from top 10% of earners. Data as of September 2025.

2- Source: Federal Reserve. Financial Stability Report, November 2025.

3- Source: MIM, NCREIF. Data as of 2Q 2025.

4- Note: Commercial Mortgages utilizes a 50/50 weighted average of Giliberto-Levy Index and Bloomberg CMBS Investment Grade Index. Private Equity utilizes the Cambridge PE Index. Private CRE utilizes NCREIF ODCE returns but with a 2-quarter look-ahead to help offset appraisal lag, Values represent the 1-year total return for each sector. Best performing sector for each year assessed by comparing average historical performance with a risk adjustment. Returns may not be comparable due to mark-to-market lag

and other factors and should not be relied on for portfolio modeling or investment decisions.

5- Based on November 2025 Delphi consensus survey of MIM’s acquisitions staff for current market pricing, aggregated portfolio information, and ratios from vendors including CoStar and Green Street. External sources include REIT and market information from MIM vendors including CBRE-EA, CoStar, and Green Street. Note: Pricing analysis is only focused on Core and Stabilized assets.

6- CBRE-EA, 2025Q3

7- Source: CBRE Econometric Advisors. Data as of 3Q 2025.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

MetLife Investment Management (MIM) is MetLife Inc.’s institutional investment management business. MIM is a group of international companies that provides investment advice and markets asset management products and services to clients around the world.

This document is solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein.

This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

The various global teams referenced in this document, including portfolio managers, research analysts and traders are employed by the various legal entities that comprise MIM.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results.

For investors in the U.S.: This document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities and Exchange Commission (SEC) registered investment adviser. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment adviser.

For investors in the UK: This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended

for, and may only be distributed to, investors in the UK who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not

for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”), a registered Financial Instruments Business Operator (“FIBO”) conducting Investment Advisory Business, Investment Management Business and Type II Financial Instruments Business under the registration entry “Director General of the Kanto Local Finance Bureau (Financial Instruments Business Operator) No. 2414” pursuant to the Financial Instruments and Exchange Act of Japan (“FIEA”), and a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. In its capacity as a discretionary investment manager registered under the FIEA, MIM JAPAN provides investment management services and also sub-delegates a part of its investment management authority to other foreign investment management entities within MIM in accordance with the FIEA. This

document is only being provided to investors who are general employees’ pension fund based in Japan, business owners who implement defined benefit corporate pension, etc. and Qualified Institutional Investors domiciled in Japan. It is the responsibility of each prospective investor to satisfy themselves as to full compliance with the applicable laws and regulations of any relevant territory, including obtaining any

requisite governmental or other consent and observing any other formality presented in such territory. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does

not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being distributed by MetLife Investments Asia Limited (“MIAL”), licensed by the Securities and Futures Commission (“SFC”) for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities in Hong Kong S.A.R. This document is intended for professional investors as defined in the Schedule 1 to the SFO and

the Securities and Futures (Professional Investor) Rules only. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are licensed by the SFC to carry on regulated activities in Hong Kong S.A.R. The information contained in this document is for information purposes only and it has not been reviewed by the Securities and Futures Commission.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different

from Australian law.

For investors in the EEA: This document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates

of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL. 11-27 5013893-[MIAL (HK), MIM Europe, MIM Japan, MIM, LLC (US), MIML (UK)].