ALTSME is an education-focused alternative investment event designed to bring the investor community together for a full day of dialogue and discussion on the most relevant topics facing investors and managers today.

ALTSME is developed and led by CAIA Association and CFA Society Doha, and is a hot spot for those seeking the very latest in alternative investment news and developments. ALTSME is specifically designed to provide relevant, education-focused content for individuals who manage, advise, allocate to, or oversee alternative investments. With leading allocating and management firms, the agenda will include topics such as global asset allocation, risk management, private markets, real assets, alternative beta strategies, private equity, hedge funds, ESG, crypto, and more.

OUR SPEAKERS

Keynote Speakers

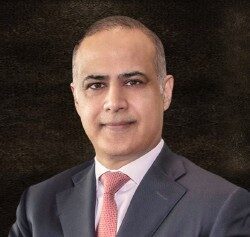

Yousuf Mohamed Al-Jaida

Qatar Financial Centre (QFC)

Board Member and Chief Executive Officer

Yousuf Mohamed Al-Jaida was appointed Chief Executive Officer of Qatar Financial Centre (QFC) in June 2015. He previously held the role of Deputy Chief Executive Officer and Chief Strategic Business Development Officer at QFC where he was responsible for leading the overall strategy and business development functions of the organisation.

Prior to joining QFC, he was Head of Indirect Investment at the Qatar General Retirement and Pension Authority, which included overseeing the management of hedge fund, private equity, real estate, fixed income, and equity portfolio investments. He has also worked for Qatar Energy and Dolphin Energy early in his career.

Yousuf serves as board member in leading local and international organisations including the World Alliance of International Financial Centers, the Qatar Financial Centre, the Qatar Finance and Business Academy, the Qatar Free Zones Authority, the Investment Promotion Agency, and Sidra Medicine.

He is also an advisory board member in the college of Islamic Studies at Hamad Bin Khalifa University , and sits on the Advisory Council of Qatar University’s College of Business and Economics.

Previously, Yousuf was on the boards of Nakilat QSC and the $1 billion strategic investment fund of Unicorn Investment Bank, as well as serving as Vice Chairman of Mayadeen Real Estate Company KSCC. He graduated from the University of Arizona, USA.

Dr. Domenico Mignacca

Qatar Investment Authority (QIA)

Executive Director of Investment Risk

Speakers

Dr. Fawad Ishaq

Doha Bank

Chief Treasury and Investments Officer

Eyad Abdulrahim

Power International Holding

Group Chief Finance and Investment Officer

Eyad Abdulrahim is a seasoned executive with three decades of expertise in corporate finance, within his roles as CFO and CIO. His career highlights include leading and advising Mega corporations through significant financial milestones such as IPOs, private placements, complex restructurings, and mergers and acquisitions across the Middle East and internationally. Eyad has played pivotal roles in numerous high-profile financial transactions including IPOs, rights issues, debt/equity swaps, reverse IPOs, and Sukuk issuances.

Chirag Doshi CFA

Qatar Insurance Company (QIC)

Group Chief Investment Officer

Chirag is responsible for managing QIC Group’s globally diversified investment portfolio of over USD 6 billion spanning across Fixed Income, Equities, Private Equity, and Real Estate. With more than two decades of experience in the investment industry, Chirag has been instrumental in shaping QIC’s long-term investment strategy and establishing its strong market positioning. He is recognized as a pioneer in the GCC fixed income space, having been among the earliest portfolio managers active in the regional bond markets when they began to emerge in 2005.

Ekta Tolani

KBW Ventures

Chief Investment Officer

Ekta, a credentialed CIO with 15+ years of experience, has deployed over $1B into direct deals globally. She excels in driving strategies for Private Equity ($100M+) and Venture Capital ($1M–$5M) deals across sectors like clean energy, healthcare, education, and technology. An MBA graduate of the University of Chicago Booth, she is an ambassador for its MBA program. A member of PEWIN, she champions women’s empowerment and maintains a robust global network of LPs, family offices, and GPs.

Junaid Jafar

Al Muhaidib Group

Chief Investment Officer

Junaid is the CIO of the Muhaidib Investment Office, overseeing the Family Office and Financial Investments at Al Muhaidib Group. His mandate spans international private markets and public markets. He previously worked at the $730m IDB Infrastructure Fund, co-founded Tadhamon Capital, and advised regional family offices. Earlier, he held roles at Janus Henderson, Fitch, JP Morgan, and KPMG. A Fellow of the ICAEW, Junaid holds an Economics and Political Science degree from Middlebury College and serves on several boards.

Bilal Abduljawad, CFA, CAIA

Sulaiman Bin Abdulaziz Al-Rajhi Holding Co.

Director-Financial Investments

Bilal Abduljawad is Acting Head of Financial Investments at Sulaiman bin Abdulaziz Alrajhi Holding Company and co-founder of Blomal. He serves on several board sub-committees and previously led investments at Kun Investment Holding, overseeing financial investments and M&A. His earlier roles include positions at Sedco Capital and Sanabil Investments. Bilal holds an MSc in Finance from ESADE Business School and a Bachelor's in Economics. He earned both the CFA and CAIA designations in 2019, reflecting his strong expertise in finance and investments.

Ramzi Bibi

Arabia Insurance Company

Head of Treasury and Investment

Mohammed Ali Yasin

Ghaf Benefits, Subsidiary of Lunate

Chief Executive Officer

Mohammed Ali Yasin joined Lunate Capital LLC as CEO in 2025 to lead the firm’s Enhanced End-of-Service benefits solution, Ghaf Benefits. He is a veteran of the UAE capital markets, with over 27 years of experience in the financial industry. Mohammed has held several leadership positions, including CEO roles at FAB Securities and Shuaa Securities. In late 2018, he was appointed Chief Strategy Officer (CSO) at Al Dhabi Capital Ltd in ADGM.

Farah Khamash, Ph.D

Qatar Central Bank

Senior Macroeconomist

Senior Economist at Qatar Central Bank’s Macroeconomic Research Department, with expertise in investment and foreign reserves, wealth management, forecasting, macroeconomic policy, and macro-financial stability. She has over 15 years’ experience across banking, central banking, and the IMF, with a vision to strengthening national wealth and foster sustainable, resilient economic growth.

Bernardo Retana

Aruya Ventures

Chief Investment Officer

Bernardo is a multi-sectoral entrepreneur and investment executive with 27 years of experience in real estate, hospitality, healthcare, and finance. He is the Chief Investment Officer of Aruya Ventures, a Doha-based group of companies with investments across multiple sectors including hospitality, real estate, and oil & gas. In parallel, he is Co-Founder and Managing Partner of Saraya Capital, a multi-family office focused on real estate investment.

Moez Mahrez, CFA,

Lesha Bank

Private Equity Manager

Moez Mahrez, CFA has a Bachelor's Degree in Economics from McGill University and is a Chartered Financial Analyst. Moez has held various roles in the finance industry, starting as a Course Counselor at McGill University, then moving on to positions as a Financial Advisor at CIBC, an Investment Advisor at TD, a Senior Investment Analyst at 5i Research Inc., and currently serves as a Senior Analyst in Private Equity at Lesha Bank. Moez has experience in managing portfolios, conducting financial analysis, advising on investments, and building relationships with clients and management. Moez also has experience in project management and event planning.

Riazuddin Mohammad, CFA, FRM, MMA

ZAD Holding Company

AVP - Investments & Business Analysis

Riazuddin Mohammad is AVP Investments and Business Analysis at ZAD Holding Company, leading global equity and multi-asset strategies for the group’s treasury investment portfolios. With over 15 years of experience across portfolio management, financial analysis, and strategic asset allocation, he has been instrumental in developing the firm’s investment framework and governance processes. Prior to ZAD, he worked with Canadian Tire Corporation in Toronto and has held multiple roles in investment research and analytics. Riaz holds the CFA and FRM designations and a Master of Management Analytics

Bogdan Bilaus, CFA, FRM, CAIA,

QFBA-Northumbria University

Investment and Risk Instructor

Bogdan is an investment professional with 24 years of experience across multiple investment classes. His expertise is investment strategies, risk management, manager selection, and performance measurment. His roles have included Head of Investments for Raiffeisen Asset Management, where he led a team managing assets of USD 1 billion, and also Funds & Portfolios Manager at Qatar National Bank (QNB) between 2013 and 2024, focusing on global equity, alternatives and special projects. Since March 2024 he has been an Advisor with the CFO office at Qatar Foundation. Bogdan has served multiple terms as President and Board Member of CFA Society Doha, member of the CFA Institute

David Earl Cook

Sharq Insurance

Chief Executive Officer

A dynamic visionary innovator and decisive senior executive driven by the human experience of leading transformation. Expertise in swift assessment building new operational models and distribution channels to build growth and delivery profit by executing strategic initiatives. Accomplished at successful market identification and strategic positioning that transforms operations to increases sales and grow the bottom line through the implementation of digital & AI assets. David was an early entrepreneur owning his own business before beginning his corporate career.

Ruggiero Lomonaco

Rasmala Investment Bank Limited

Head of Real Estate

Ruggiero serves as Head of Real Estate Funds with responsibilities for managing an international portfolio of single tenant net leased properties. Ruggiero has over 30 years of experience in the investment management industry and specializes in Sharia compliant products. Prior to joining Rasmala, Ruggiero held senior management positions at JP Morgan Chase, HSBC and ABN AMRO. Ruggiero holds a Magna-cum laude degree in Economics e Finance from La Sapienza University in Rome and is a qualified public accountant in Italy (Dottore Commercialista).

Ju Hui Lee

United Nations Joint Staff Pension Fund (UNJSPF)

Head of Investment Risk and Performance

Mohamed Seghir

HAYAH Insurance Company

Chief Executive Officer

As an Insurance and Wealth Management professional with extensive experience in international and diverse environments (over 40+ countries covered), my focus has been on driving innovation across various sectors such as reinsurance, pension, life insurance, financial planning, bancassurance, and Takaful in the MENA region. My commitment to the industry is demonstrated through active participation in seminars, training sessions, conferences, and articles, where I share insights and foster learning. I believe in redefining the role of an actuary to be more aligned with the changing times- embracing innovation, dynamism, and a forward-thinking approach.

Rosewood Doha

Lusail Marina

Zone 69, street number 309, Building number 11

Doha

Qatar

Client Testimonials

Our clients love us, here are a few of their quotes.

Our Sponsors

Co Hosts

AQatar Financial Centre Authority

The Qatar Financial Centre (QFC) is an onshore business and financial centre located in Doha, established by Law No. 7 of 2005 of the State of Qatar. A world-class platform for companies, QFC offers its own legal, regulatory, tax and business environment, contributing to the decisive economic development and diversification prescribed by Qatar National Vision 2030.

Supported by QFC’s broad range of legal and regulatory services, regulated and non-regulated, that align with international best practice, domestic and international companies can set up or expand their business in Qatar.

QFC allows up to 100% foreign ownership, 100% repatriation of profits, and charges a competitive rate of 10% corporate tax on locally-sourced profits, all while integrating businesses into Qatar’s swift expansion into a major trade and investment centre.

QFC is governed by the following four independent bodies. Its business-friendly ecosystem operates in line with international best practice to ensure clients receive optimal operational, regulatory, and judicial support.

BCFA Society Doha

CFA Institute is the global association of investment professionals that sets the standard for professional excellence and credentials. The organization is a champion of ethical behavior in investment markets and a respected source of knowledge in the global financial community. Our aim is to create an environment where investors’ interests come first, markets function at their best, and economics grow. Our network of more than 160 societies helps carry out our global mission in local markets. www.cfasociety.org

CAIA Association

CAIA Association is a global network of forward-thinking investment professionals, redefining the future of capital allocation in a world where traditional and alternative converge. United by a commitment to improving investment outcomes, we lead with authority, educate to inspire, and connect people who turn insight into action. To learn more about the CAIA Association and how to become part of the most energized professional network shaping the future of investing, please visit us at https://caia.org/.

Lead Sponsors

World Gold Council

Based in London, World Gold Council is a team of gold experts that champions the role gold plays as a strategic asset through research, analysis, commentary and insights.

We report to, and are owned by, a forward-thinking group of listed gold miners, and drive industry progress, shape policy and set the principles for a perpetual and sustainable gold market.

Platinum Sponsors

FC Capital

FC Capital, based in Sydney, is Australia’s predominant corporate and specialty finance alternative asset manager, specialising in private debt. Since 2012, the firm has provided tailored capital solutions to institutional investors across Australia and New Zealand. FC Capital focuses on mid-market companies, offering senior secured structured credit instruments. With a strong track record and deep market expertise, the firm delivers premium, high-yielding investments, seeing over AUD 3 billion in opportunities annually and yielding 12% to 15% p.a.

Gemcorp Capital

Gemcorp Capital was established in 2014 and is an Alternatives Investment Manager with ca. $1B AuM, with headquarters in London, UK. The firm’s regional focus has been on Emerging Markets, including the Middle East, having set up a key regional office in Sub-Saharan Africa (Angola). Additional satellite offices include Geneva, UAE, New York, Singapore, Kenya and South Africa. Gemcorp specializes in the origination, structuring and deployment of Private Credit investment opportunities.

Principal

Principal Investor Management (DIFC) Limited (“Principal”), specializes in distributing and promoting asset management products and services from Principal Asset Management, the global investment solutions business for Principal Financial Group® which manages US$1.6 trillion in AuA for more than 1,100 institutional clients in more than 80 markets worldwide. Principal Asset Management manages over US$ 585.6bn in AuM in public markets, private markets and solutions strategies. Principal is registered in the Dubai International Financial Centre and authorized by the Dubai Financial Services Authority as an Authorised Firm serving institutional investors, pension plan sponsors and sovereign wealth fund managers throughout the Middle East.

SovFi

SovFi is a provider of quantitatively engineered structured instruments and financial liquidity solutions for Sovereign, Supranational, and Agency (SSA) issuers and national capital markets.

SovFi leverages traditional finance (TradFi) and decentralized finance (DeFi) in its innovative solutions.

The solutions offered by SovFi span an innovative asset and exchange scoring methodology and data platform; a real-time data aggregation layer that consolidates on-chain and off-chain market signals into a single institutional-grade framework; hybridized structured instruments that capture multiple asset classes including debt, equity, and commodities; and capital markets instruments that serve as Foreign Direct Investment (FDI) Bridges which facilitate investment in sovereign states using established capital markets

Gold Sponsors

Patience Capital Group

Established in 2019 with offices in Tokyo and Singapore, Patience Capital Group (PCG) is an investment manager specialising in Real Estate and Private Equity transactions in Japan. The firm offers extensive expertise in investment, project development, and asset management, alongside value creation across multiple sectors including hospitality, residential, and retail. Leveraging its vast networks and best-in-class deal sourcing and execution capabilities, PCG pursues strong risk-adjusted returns over the long term. The firm was founded by Ken Chan, 19-year GIC veteran and former Country Head of Japan, who oversaw the sovereign wealth fund’s real estate portfolio in the country.

Silver Sponsors

Nikkei Europe

Founded in Japan in 1876, Nikkei is one of the world’s largest independent media groups, with 2.3 million paid subscribers. Since acquiring the Financial Times in 2015, Nikkei has expanded its global presence.

We provide institutional investors with high-quality Japanese equity market data, including alternative datasets such as POS and news analytics, and index constituent data for major benchmarks like the Nikkei 225, supporting informed investment decisions and portfolio construction.

Preqin

Preqin empowers financial professionals who invest in or allocate to private markets with essential data and insight to make confident decisions. It supports them throughout the entire investment lifecycle with critical information and leading analytics solutions. Preqin has pioneered rigorous methods of collecting private data for over 20 years, enabling more than 200,000 professionals globally to streamline how they raise capital, source deals and investments, understand performance, and stay informed. Acquired by BlackRock in 2025, Preqin complements the existing Aladdin technology platform to provide investment solutions for the whole portfolio. For more information visit www.preqin.com.

RBC Global Asset Management

RBC GAM’s BlueBay fixed income platform seeks to embody the best aspects of alternative credit investing by providing clients access to emerging trends and dislocation within global markets through vehicles optimized to manage risks and execution. By leveraging a single investment platform, we can utilize the substantial resources across our entire business with more than 130 investment professionals to create differentiated portfolios. Through this approach, we seek to meet our clients’ risk/return objectives while providing additional diversification across their overall portfolio. Today, we are a leading global alternative credit specialist manager with a comprehensive offering across the sub-asset classes and we continue to evolve and innovate in an ever-changing market.

Select Equity Group

Select Equity was founded in 1990 and manages roughly $33 billion across a small number of equity strategies that share a common investment philosophy and a centralized research process. We offer US and non-US long-only and long/short equity strategies, as well as private equity and early-stage venture capital strategies. SEG Partners, our flagship US long/short equity strategy launched in 1998, is a high-conviction, mid-cap-focused portfolio driven by rigorous, independent fundamental research. Astor Place Holdings, established in 2015, is Select Equity’s private equity arm focused on long-term, patient capital investments in founder- and family-owned lower middle-market industrial technology and aerospace & defense companies. Venrex, acquired in 2022, is an early-stage venture capital strategy investing primarily in technology-enabled consumer businesses in the US and UK. Our 75-person research team identifies what we believe to be the highest-quality businesses the equity markets offer, and our process is fiercely independent – we do not use Wall Street research or share ideas with other managers. Learn more at www.selectequity.com.

StoneX

A Trusted Market leader

FOREX.com is a global market leader in providing independent traders the technology and tools they need to connect to global markets since 2001. We are known internationally for our breadth of offerings, our competitive spreads, our trading platforms and our customer service. Our award-winning platforms, service and technology have been utilized by over 500,000 traders around the world, and we continue to strive to provide traders with everything they could possibly need to help them succeed.

Your profits are safe with us

FOREX.com is registered with multiple regulatory bodies around the world and we take our commitment to financial strength and security very seriously, enabling you to trade with greater confidence. Our Dubai office is licensed by the UAE Central Bank License to operate as a Representative Office for FOREX.com in the UAE.

We do not stand alone

Our parent company is StoneX Group Inc. (NASDAQ: SNEX), an institutional-grade financial services network that connects companies, organizations, traders and investors to the global markets through a unique blend of digital platforms, end-to-end clearing and execution services, high-touch service and deep expertise.

Interested in sponsoring?

Sponsorship OpportunitiesKey Discussion Topics

LATEST THINKING IN ASSET ALLOCATION

OPPORTUNITIES IN THE PRIVATE MARKETS & PRIVATE EQUITY: ADAPTING TO ECONOMIC UNCERTAINTY AND POLICY SHIFTS

INSTITUTIONAL AND PRIVATE WEALTH INVESTORS DISCUSS ASSET ALLOCATION TRENDS, GOVERNANCE AND ESG

REAL ASSETS: INFRASTRUCTURE AND ENERGY

THE PORTFOLIO OF 2030, THE FUTURE OF ALTERNATIVE INVESTING

Registration

INVESTORS: Complimentary Registration for all qualified investors. Email IR@marketsgroup.org for more information on obtaining a complimentary ticket.

MANAGERS & SERVICE PROVIDERS: Rates below reflect the current price for all asset managers and service providers.

Please ensure to select the number of tickets you'd like to register for before proceeding

Media Partnerships

+1 212-600-8631

John.Zajas@marketsgroup.org

Allocator Attendance

+1 347-778-2568

IR@marketsgroup.org

Sponsorship Opportunities

+1 212-804-6220

Sales@marketsgroup.org

Research

Behind the Event

The numbers that highlight Market Group's journey, our impact, and our commitment to exceptional events.