Elliott Investment Management is reviewing strategic options for Ark Data Centres, its UK-based operator, in a potential sale that could raise more than £3 billion ($4 billion), according to two people familiar with the discussions.

The U.S. hedge fund has held preliminary talks with advisers regarding a possible process, which could launch early next year, one source said. Another added that initial approaches have already been made to infrastructure investors, though no formal decisions have been taken. Elliott had attempted to sell Ark in 2023, but offers reportedly fell short of expectations.

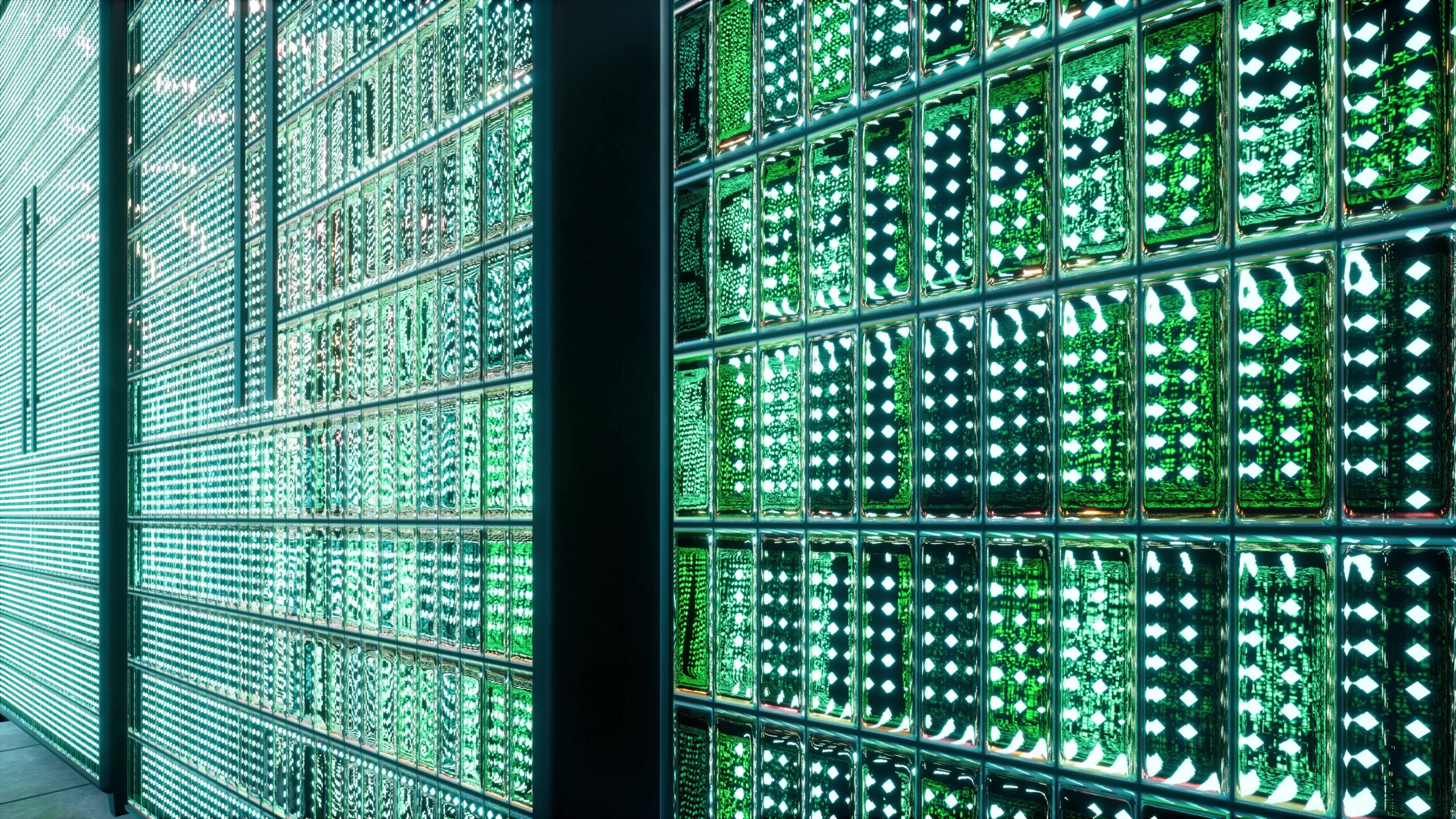

Market dynamics have shifted since then, with demand for data centres accelerating on the back of artificial intelligence and cloud computing adoption. Since OpenAI’s launch of ChatGPT in 2022, investor appetite for the sector has surged. McKinsey estimates that global data centre investment will total $6.7 trillion by 2030 to meet AI-driven computing demand.

Elliott, which acquired Ark in 2012 through its private equity arm, declined to comment, while Ark did not respond to requests for comment. European real estate investor Revcap, which holds a minority stake, also did not comment. Ark operates a joint venture with the UK government called Crown Hosting Data Centres, providing access to public-sector hosting requirements.

The industry has been active with deal-making. Earlier this week, OpenAI, Oracle, and SoftBank announced plans for five new AI data centres under the Stargate project, a private initiative backed by U.S. President Donald Trump that aims to invest up to $500 billion in AI infrastructure. Meanwhile, Singapore’s SC Capital has been in talks to acquire British operator Global Switch in a deal that could value the business at up to $5 billion.

Source: Reuters