By Christine Giordano

When you are an allocator, sometimes it seems there are always hundreds of managers who want just a few minutes of your time.

With thousands of requests for meetings from managers each year, things might become a blur after the um-teenth presentation on different variations on credit, private equity, or fixed income products and funds. Strategies can begin to sound too similar. And it can be difficult to distinguish the truly winning philosophies from those that might leave assets lost in the land of high expectations or delayed returns on investments.

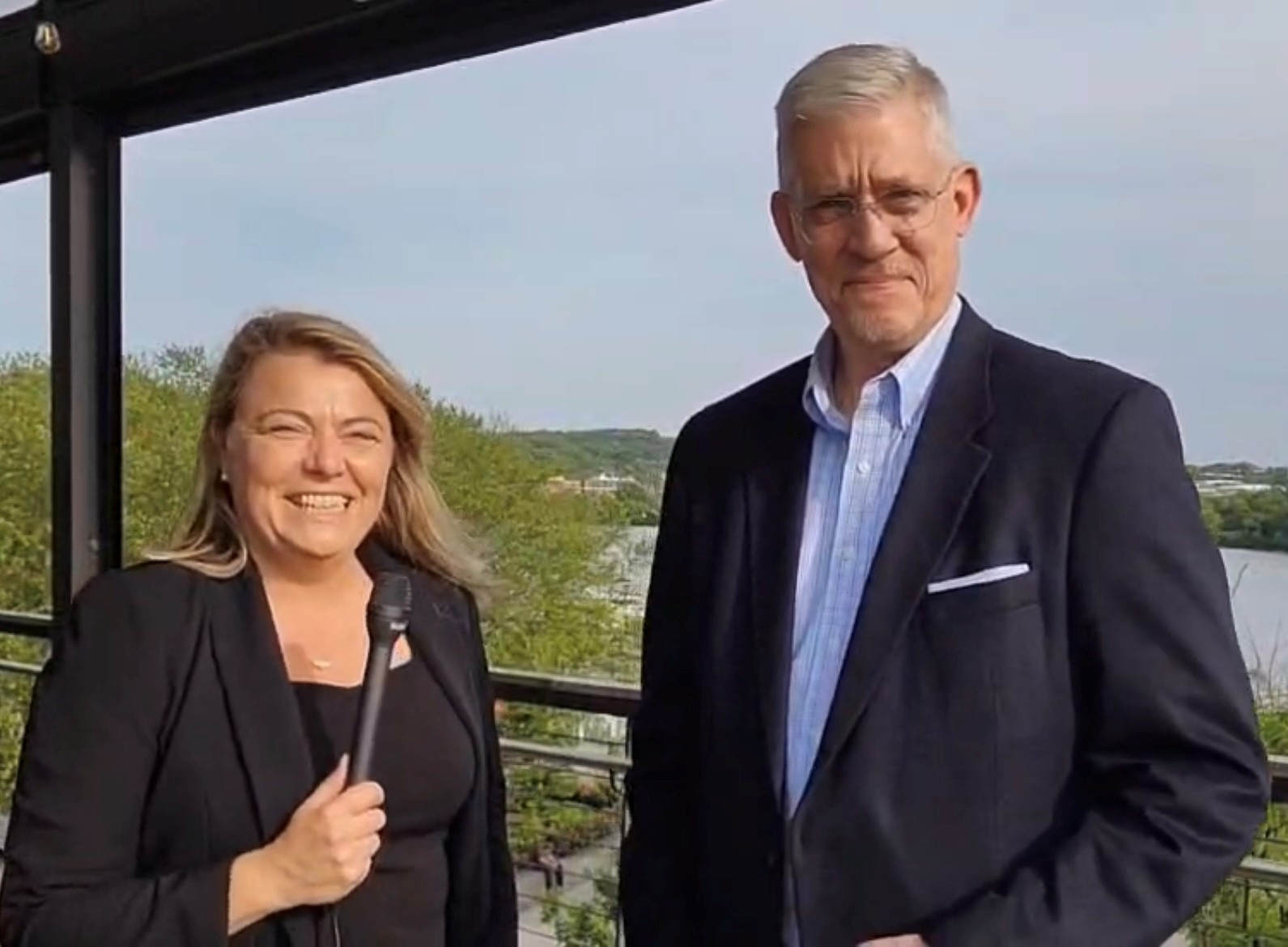

Jonathan Hook, aka “Captain Hook,” was recently celebrated by Markets Group with a Lifetime Achievement award at the Mid-Atlantic Region Investment Forum for founding three successful investment offices at Baylor University, Ohio State University, and the Harry and Jeanette Weinberg Foundation. During his tenure as a chief investment officer, he faced challenges with his small investment teams but had a knack for achieving higher returns than the OCIO firms that traditionally held the funds. One of his claims to fame is scoring top endowment returns while being a team of one, a feat that is almost impossible without wise manager choices, which makes him a bit of an expert on choosing some of the top managers for smaller endowments and foundations.

We asked him, what the most important question is to suss out the better managers.

“I think when you’re really trying to decide between 10 managers that all do the same thing, the most important area of questioning is the why,” said Hook. All variations of the why question can really help an allocator dig a bit deeper to see the thought processes behind the firm’s investments or strategic goals.

Consider asking:

Why are they doing what they’re doing?

Why are they the best?

Why do they fit your portfolio?

Making sure that you have a satisfying answer for all of the why questions can truly underpin an allocators investment choices going forward, he added.

“I think the why question is one that barely gets asked enough,” said Hook. “We can all look at returns for what they’ve done over the one-, three-, five-year time periods. Everyone can see that. But it’s really [about] getting much deeper to what drives the people at the firm.”