|

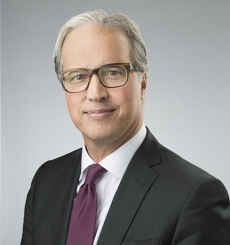

Jonathan Coslet, Chief Investment Officer, TPG

Jonathan Coslet is the Chief Investment Officer of TPG Global. He is Chairman of TPG Capital’s Investment Committee and a member of the TPG Holdings Executive Committee. Mr. Coslet joined TPG at its inception in 1993. Prior to joining TPG, Mr. Coslet worked at Donaldson, Lufkin & Jenrette from 1991 to 1993 and at Drexel Burnham Lambert from 1987 to 1989 where he specialized in leveraged acquisitions. Mr. Coslet received his MBA from Harvard Graduate School of Business Administration in 1991, where he was a Baker Scholar and a Loeb Fellow. Mr. Coslet received his B.S.E. in Economics (Finance) from the University of Pennsylvania Wharton School, where he was Valedictorian, summa cum laude, a Gordon Fellow and a Steur Fellow. Mr. Coslet currently serves on the Boards of Directors of IQVIA, Life Time Fitness, and Cushman & Wakefield. He previously served on the Boards of Directors of Petco, Biomet, Burger King, J.Crew, Fidelity National Information Services, Endurance Specialty, Oxford Health Plans, Iasis Healthcare, Neiman Marcus and several others. Mr. Coslet also serves on the Board, Strategy and Finance Committees of Stanford Children’s Hospital, the Stanford Medicine Advisory Council, the Stanford Institute for Economic Policy Research Advisory Board, the Investment Committee for Eastside Preparatory School and as a Trustee for Menlo School. He also has previously served on the Harvard Business School Board of Advisors, the Federal Reserve Bank of San Francisco Economic Advisory Council and the Hamilton Project.

|

Request Agenda

Request Agenda