|

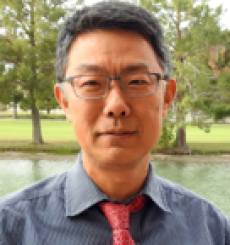

Joe Aguilar, Chief Investment Officer, Illinois State Treasury

Joe Aguilar is the Chief

Investment Officer for Illinois State Treasurer Michael W. Frerichs. In his

role, Mr. Aguilar directs seven investment portfolios spanning across public

and private market investments on behalf of the Illinois Treasury’s combined $56

billion investment portfolio including the Illinois Growth and Innovation Fund,

a $1.5b impact investment fund investing across venture, buyout and private

credit, the FIRST Fund, a $1.5b vehicle dedicated to infrastructure and real

estate, two 529 College Saving Plans, the State’s Achieving a Better Life

Experience program, Student Empowerment Fund, and the Secure Choice Retirement

Savings Program. As the Chief Investment Officer, Mr. Aguilar leads all aspects

of investment implementation, including the development of processes and

procedures, asset allocation, the Office’s sustainable investment strategy, and

the selection of investment products and managers. He is responsible for

leading the investment team and the stewardship for all investments and external

public and private market investment managers including venture, private

equity, infrastructure, real estate and private credit managers invested

through the office’s platforms.

Mr. Aguilar was previously

the Director of Investment Analysis and Due Diligence with the Illinois State

Treasury in which he led due diligence efforts in

which he led the manager selection process, assessment, and monitoring of all

investment managers and co-investments. Prior to joining the Illinois Treasury,

he worked for Fortaleza Asset Management. Mr. Aguilar holds a B.S. with a

double major in Finance and Business & Commerce from Aurora University and

an M.S. in Finance from the University of Miami’s Herbert Business School. He

also serves as a Board Member for the Council of Institutional Investors, Board

Chair and Chair of the Investment Committee for the Field Foundation of Illinois

and is an Adjunct Professor at Aurora University. |

Request Agenda

Request Agenda