|

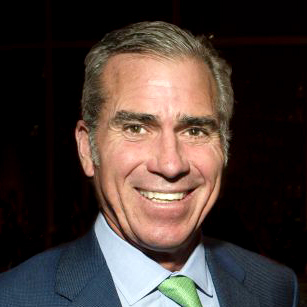

Adam Blitz, CFA, Chief Executive Officer, Chief Investment Officer, Evanston Capital Management

Mr. Blitz is the Chief Executive Officer, Chief Investment Officer, a Principal, a member of the Investment Committee of Evanston Capital Management, LLC, and a member of its Board of Managers. He has over fifteen years of institutional investment management experience with an emphasis in quantitative analysis, trading and risk management. Prior to helping establish Evanston Capital Management, Mr. Blitz worked in the Prime Brokerage area at Goldman, Sachs & Co., where he was responsible for developing, selling, and managing funding and financing products to offer to hedge funds. He also worked closely with the risk management group within Prime Brokerage, which is responsible for determining the appropriate amount of leverage to extend to hedge funds from both a regulatory and risk-based perspective. Before joining Goldman Sachs, Mr. Blitz was the Head Trader at AQR Capital Management, a multi-strategy quantitative investment manager. At AQR, Mr. Blitz was responsible for implementing all of AQR’s market-neutral strategies and traded a wide variety of financial instruments, including equities, bonds, currencies, futures, and swaps. Mr. Blitz also assisted in risk management and strategy research at AQR, including extensive modeling and analysis of strategy and fund-level volatilities and correlations. Mr. Blitz also was previously employed in the Asset Management Division at Goldman Sachs, where he was a member of the Quantitative Research group. Mr. Blitz received his B.S. in Economics from the University of Pennsylvania’s Wharton School. He serves as a member of the Board of Advisors of Northwestern University’s School of Education and Social Policy, is a CFA charterholder, and is a member of the CFA Institute and the CFA Society of Chicago.

|

Request Agenda

Request Agenda